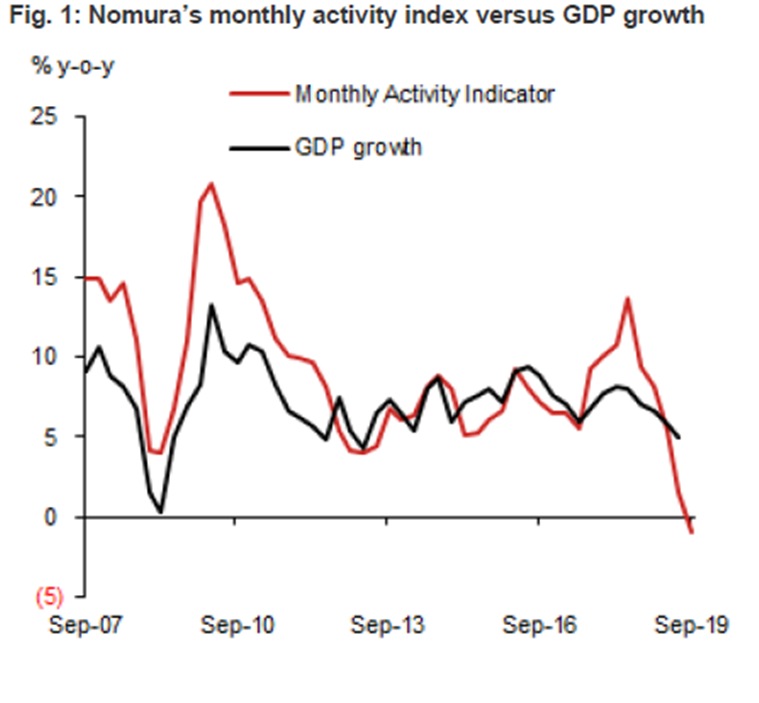

High-recurrence markers recommend that GDP development rate may have kept on decelerating among July and September.

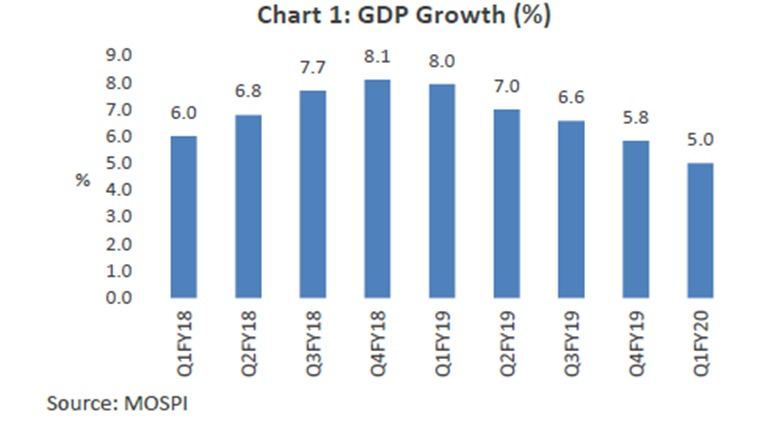

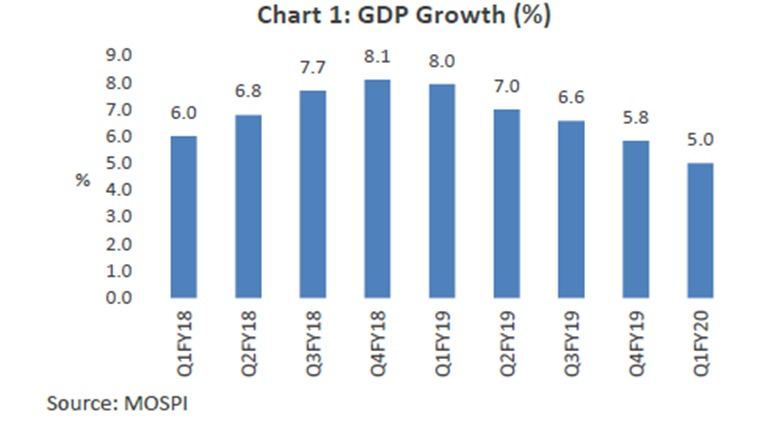

As the Reserve Bank of India's Monetary Policy Committee declares its every other month approach survey on October 4, it would realize that the Indian economy is confronting its most noticeably terrible log jam since the plunge in monetary action following the worldwide money related emergency of 2008-09. As this diagram from Care Ratings appears, financial development has been decelerating for as long as five quarters ( that is the most recent 15 months).

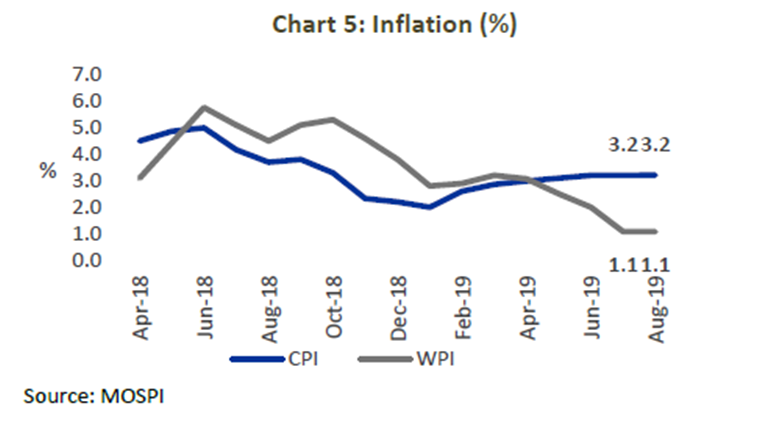

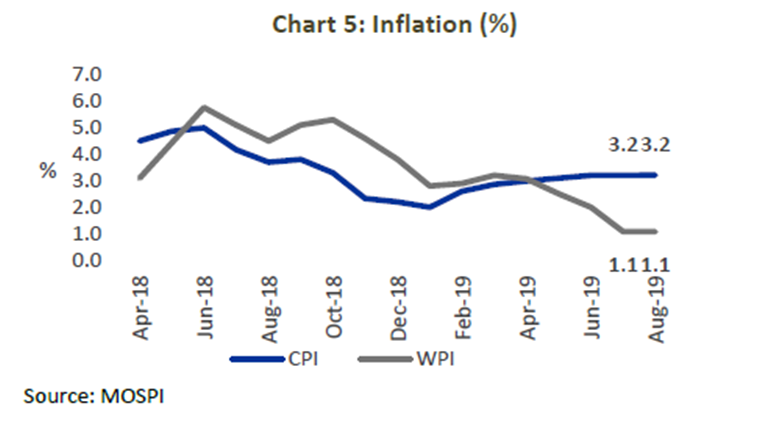

However, from RBI's point of view, fortunately, at any rate the swelling rate (that is the pace of increment in costs) – both at discount (WPI) and retail (CPI) levels – has been well leveled out.

That is the reason, since the beginning of this schedule year, the RBI has had the option to forcefully cut the benchmark repo rate – the rate at which it loans to the financial framework. A repo rate chop cuts down the expenses of raising assets for the financial framework and sign a cut in all cases.

Be that as it may, regardless of cutting the repo rate by 110 premise focuses – 100 premise focuses equivalent one rate point – since February, RBI has not had the option to get banks to go through the full cut; the go through has been just around 40 premise focuses. That is on the grounds that the repo rate isn't the most significant determinant of the expense of assets for banks. The greater determinants are the pace of premium banks pay investors and the pace of premium that contributors win on little reserve funds plans, for example, the Sukanya Samriddhi Yojana or the open opportune store that the administration runs. The way that banks, particularly the open division ones, have been battling with a pile of credits that turned sour didn't improve the situation as each quarter banks needed to divert their benefits (which would have generally helped them loan to new organizations) towards stopping the hole made by such non-performing resources.

What is probably going to occur on October 4 strategy survey?

Despite the absence of transmission before, the RBI is probably going to cut repo rate by anyplace between 35 to 40 premise focuses. That is for an assortment of reasons.

One, swelling is leveled out and there is space to decrease loan fees without energizing a flood in the value level. Two, if the transmission is frail, a more profound slice is required to accomplish the objective. Three, the legislature has quite recently cut corporate duty rates in its offer to boost more speculations; cutting loan costs will further help that objective as it would profit. In conclusion, similarly as with numerous banks presently ready to connect the financing costs on new credits to the repo rate, a bigger rate cut will help in snappier transmission of rate cuts," says Suvodeep Rakshit, Vice President and Sr. Business analyst, Kotak Institutional Equities.

Will it help to support financial action?

A cut in repo rate can't exacerbate the situation; it can just help at this crossroads despite the fact that even Chetan Ghate, an individual from the RBI's MPC, has addressed how far can rates be cut. That is on the grounds that the more extensive force of the economy is downhill and it is conceivable that in the second quarter of the monetary year – that is, July-September – witnesses similarly as frail a financial development as in Q1, when GDP developed by just 5 percent.

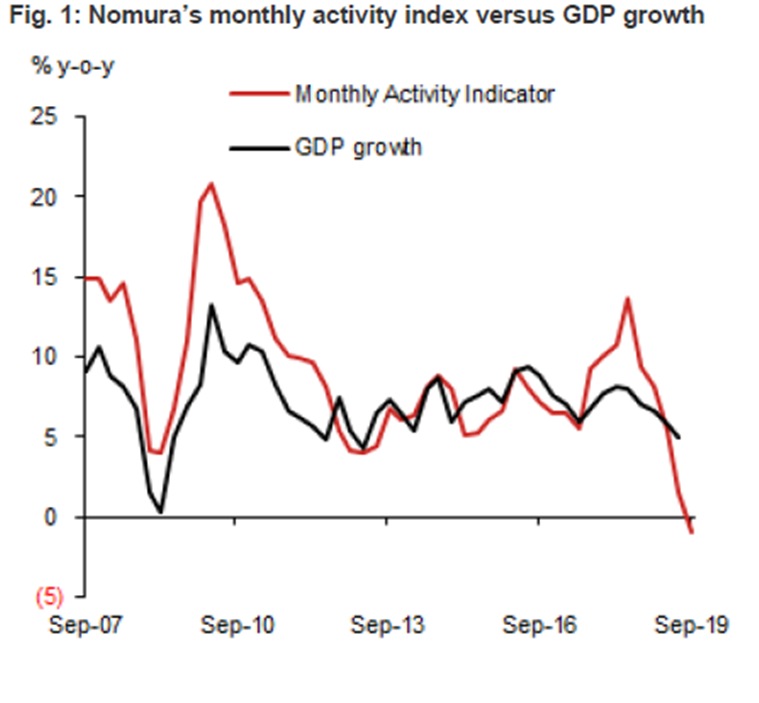

The outline from Nomura look into nearby maps Nomura's month to month movement list (MAI), which is a weighted normal of nineteen high-recurrence markers. It is intended to measure basic monetary energy. As indicated by an ongoing report by Nomura look into, "development of Nomura's MAI has been directing since H2 2018… it is currently beneath the trough hit during the worldwide money related emergency."

In less complex terms, development is probably going to plunge further when the Q2 information is uncovered later on in the year.

As the Reserve Bank of India's Monetary Policy Committee declares its every other month approach survey on October 4, it would realize that the Indian economy is confronting its most noticeably terrible log jam since the plunge in monetary action following the worldwide money related emergency of 2008-09. As this diagram from Care Ratings appears, financial development has been decelerating for as long as five quarters ( that is the most recent 15 months).

However, from RBI's point of view, fortunately, at any rate the swelling rate (that is the pace of increment in costs) – both at discount (WPI) and retail (CPI) levels – has been well leveled out.

That is the reason, since the beginning of this schedule year, the RBI has had the option to forcefully cut the benchmark repo rate – the rate at which it loans to the financial framework. A repo rate chop cuts down the expenses of raising assets for the financial framework and sign a cut in all cases.

Be that as it may, regardless of cutting the repo rate by 110 premise focuses – 100 premise focuses equivalent one rate point – since February, RBI has not had the option to get banks to go through the full cut; the go through has been just around 40 premise focuses. That is on the grounds that the repo rate isn't the most significant determinant of the expense of assets for banks. The greater determinants are the pace of premium banks pay investors and the pace of premium that contributors win on little reserve funds plans, for example, the Sukanya Samriddhi Yojana or the open opportune store that the administration runs. The way that banks, particularly the open division ones, have been battling with a pile of credits that turned sour didn't improve the situation as each quarter banks needed to divert their benefits (which would have generally helped them loan to new organizations) towards stopping the hole made by such non-performing resources.

What is probably going to occur on October 4 strategy survey?

Despite the absence of transmission before, the RBI is probably going to cut repo rate by anyplace between 35 to 40 premise focuses. That is for an assortment of reasons.

One, swelling is leveled out and there is space to decrease loan fees without energizing a flood in the value level. Two, if the transmission is frail, a more profound slice is required to accomplish the objective. Three, the legislature has quite recently cut corporate duty rates in its offer to boost more speculations; cutting loan costs will further help that objective as it would profit. In conclusion, similarly as with numerous banks presently ready to connect the financing costs on new credits to the repo rate, a bigger rate cut will help in snappier transmission of rate cuts," says Suvodeep Rakshit, Vice President and Sr. Business analyst, Kotak Institutional Equities.

Will it help to support financial action?

A cut in repo rate can't exacerbate the situation; it can just help at this crossroads despite the fact that even Chetan Ghate, an individual from the RBI's MPC, has addressed how far can rates be cut. That is on the grounds that the more extensive force of the economy is downhill and it is conceivable that in the second quarter of the monetary year – that is, July-September – witnesses similarly as frail a financial development as in Q1, when GDP developed by just 5 percent.

The outline from Nomura look into nearby maps Nomura's month to month movement list (MAI), which is a weighted normal of nineteen high-recurrence markers. It is intended to measure basic monetary energy. As indicated by an ongoing report by Nomura look into, "development of Nomura's MAI has been directing since H2 2018… it is currently beneath the trough hit during the worldwide money related emergency."

In less complex terms, development is probably going to plunge further when the Q2 information is uncovered later on in the year.

0 Comments